New Workers Care Program....

Saves 18-30% On Workers Compensation Premiums

Reduce Annual FICA Taxes By Up To $879 Per Employee Annually

Ability to Decrease Employee and Employer Medical Expenses

Guaranteed Universal Life Insurance For Employees

Enhanced Medical Care Program For Employees & Their Families. On Top Of Existing Plans

Attract & Retain "A" Players With More Competitive Compensation Package

No Extra Costs To Employer or Employee

No Risk or Obligation, Big Upside Potential

Find Out If Your Company Qualifies

Submit Your Details Below!

................................................................................

It's YOUR Money

The Affordable Care Act creates new incentives to promote employer wellness programs to support healthier workplaces and deliver deep discounts.

Better Benefits at No Additional Cost

Our robust program allows you to obtain significantly better benefits for your employees with no additional cost to you or them, including Universal Life.

Happy, Healthy Workforce

The 360 Wellness Plan benefits covers over 40 categories of care within physical health, mental health, financial, and wellness assistance.

Proven Workers Comp Carriers

Recognized by multiple A+ Worker's Compensation Carriers and has been proven to lower risk classifications and improve claim submissions.

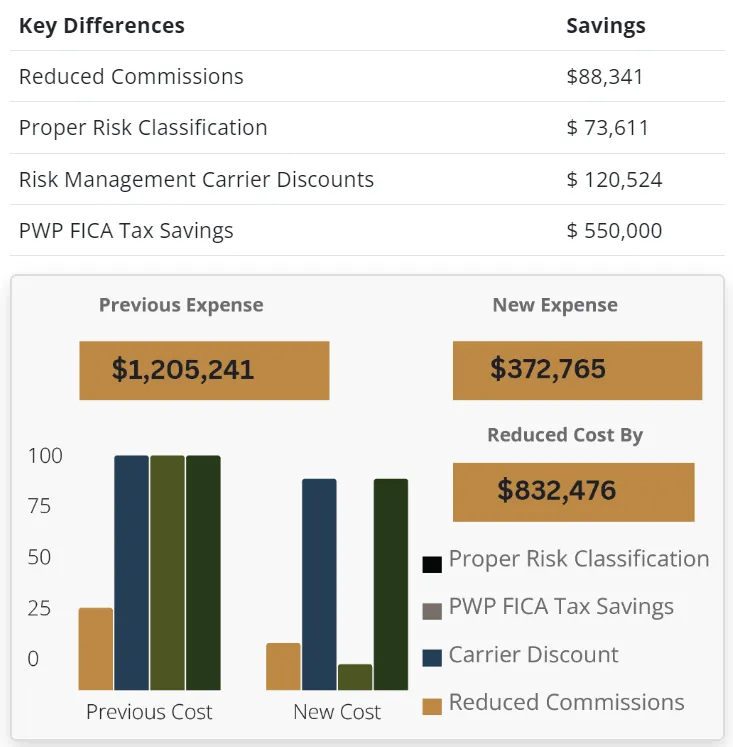

Real World Case Study...$832 K To The Bottom Line

How may new sales would you have to generate to create that type of growth?

More Case Studies

Manufacturing Firm Saves $1,503,000 Annually

5000 Full-Time Employees

Current Workers Compensation Premium $2,000,000+ Risk

Risk Management Plan Implemented July 1

4500 Eligible For Wellness Program

95% Participation Rate

Results

Workers Compensation Proposal Quote With Recategorization

Final Accepted Quote $1,520,000

$500,000 Annual Savings Workers Compensation Expense

$1,003,000 Annual FICA Expense Savings

TOTAL SAVINGS: $1,503,000 Annually

Construction Firm Savings $220,375 Annually

150 Full-Time Employees

Current Workers Compensation Premium $450,000+

Risk Management Plan Implemented July 1

125 Eligible For Wellness Program

83% Participation Rate

Results

Workers Compensation Proposal Quote With Recategorization

First Quoted $360,000 - Final Quote $295,000

$155,000 Annual Savings Workers Compensation Expense

$63,375 Annual FICA Expense Savings

TOTAL SAVINGS: $220,375 Annually

School District Saves $536,275 Annually

950 Full-Time Employees

Current Workers Compensation Premium $950,000+

Risk Management Plan Implemented July 1

925 Eligible For Wellness Program

97% Participation Rate

Results

Workers Compensation Proposal Quote With Recategorization

First Quoted $756,000 - Final Quote $615,000

$330,000 Annual Savings Workers Compensation Expense

$206,275 Annual FICA Expense Savings

TOTAL SAVINGS: $536,275 Annually

No Upfront Cost • No Risk • No Obligation

Get Started Today!

Speak to one of our

benefit experts today and receive a complimentary

proposal on how we can reduce your

Paul-Bjorn-Headercosts and increase your bottom line. We work with businesses

one-on-one and handle the entire process on their behalf so it's PAIN FREE

Here's How We Do It

Reduced Commissions

Wholesale pricing produces lower costs in worker's compensation premium. It's that simple. You're probably paying way too many people in the daisy chain for your present coverage!

Proper Risk Classification

Reclassification is accomplished by improving the Experience Modification Rating (EMR/XMod). This is accomplished through proper Risk Management Resources so your coverage "fits" for your Company

Risk Management Resources

By providing wellness resources, that are at no-out-of-pocket cost, create incentivized participation, which will improve overall health and wellness of the employee. Providing cash and care reducing the risk of claims for a happy, healthy workforce.

Carrier Discounts With Approved Benefits

If the overall risk in the workplace is minimized the premium of worker's compensation insurance you pay will be lower. The better the track record, the lower the costs.

Frequently Asked Questions

What Is The Workers Care Program?

The Workers Care Program and their Affiliates specialize in helping large companies reduce costs and increase bottom line profits by offering cutting edge insurance products with expanded wellness benefits, including free universal life policies for their employees.

This seems too good to be true?

We are proud of this. Our edge comes from a solid grasp of the healthcare benefits landscape and a dedication to innovation. We enhance your existing benefits through strategic, compliant solutions without out-of-pocket costs for you. Our network of expert providers enables us to offer unique solutions, making what seems too good to be true a reality for your business. Just give us a chance to prove exactly how this works.

How much does it cost?

There is no true net cost for the employer or qualified employees. The program is fully funded out of the tax savings that are generated by implementing this program. We have a couple different options based on client preferences, but there will never be any upfront or out-of-pocket costs to implement this, and the additional tax savings and reduced expenses drop straight to the bottom line increasing profitability and enterprise value.

Is there any cost to get a proposal?

There is no cost or obligation to receive a proposal, we simply need to preform a quick discovery call the ensure your company can qualify prior to preparing a proposal.

How does this help my business?

This program can help solve recruitment, retention, and revenue concerns and/or goals that employers have. It gives them a competitive edge by offering additional benefits and perks that can help recruit talented employees to grow the company and retain them for longer compared to other companies that don't offer these types of benefits and incentives.

How does it work?

All our team needs is a simple payroll report called a "census" to calculate the projected tax savings (confidential info can be redacted). Then, assuming you want to move forward, a simple payroll integration is set up via API (we handle that with your payroll department/service). Then we'll spend a couple weeks to help explain how the program works to the employees as well as the additional benefits that they now have access to, and that's pretty much it.

Does this impact or change our current benefits?

Nope, this program does not change or replace anything you currently have in place - it is purely an enhancement. So whether your organization currently offer benefits or not, this program basically just bolts on.

Do I need to switch from my existing provider?

There is no need to switch providers. We offer a supplementary plan that works alongside your existing coverage, enhancing benefits without requiring any hassle or changes.

Will our employees need to change doctors?

Absolutely not. Your staff can keep their current doctors. Our plan adds value by offering additional options for healthcare and savings, recommended by their doctors, without any mandatory changes.

How do you educate our team?

Our onboarding team handles everything so you don't have to. Our goal is to ensure your employees are well-informed and engaged with the additional benefits they now have access to and will have a point of contact with our team if any questions come up.

Is this compliant?

Yes absolutely - compliance is critically important with these types of programs. Understanding and following the tax code as it's written is the single most important factor, because if it's done incorrectly, it defeats the purpose of the tax savings and incentives. For that reason, we have multiple legal opinion letters as well as backing from an A-rated insurance carrier (who is literally in the business of calculating risk). Likewise, it has also passed the legal teams of many Fortune 500 clients - which means A LOT of due diligence has been done it. That said, we're happy to provide you with every ERISA document, tax code citation, and legal opinion that you could possibly need to make an educated decision on a program like this.

How do we get started?

Feel free to submit a form on our website and someone will reach out asap (5-10 min Q&A call). If you're interested, they'll set you up with a comprehensive presentation with a licensed advisor. After that, it takes our onboarding team approximately 3-5 weeks to get your payroll integrations set up/educate the employee base, but then it's pretty much hands off from there

If there is no cost how do The Workers Care Program and their Affiliates get compensated?

Our organization gets compensated by the Insurance Company for bringing on qualified participants. Since the employer or the employee do NOT pay any out of pocket costs for the program you are not paying us a penny.

What are the minimum qualifications?

In order to qualify the business must have a minimum of 25 Full Time W2 Employees.

Do other Companies offer similar programs?

There are numerous Companies that offer "pieces and parts" of what we are offering, but the Workers Care Program is unique in it's level of comprehensiveness. Additionally we are constantly searching the market for new programs to ensure our clients get the best fit for their company and their employees.

Workers Care Program - Happy Teams - Healthy Bottom Lines

Privacy Policy | Terms Of Service | Contact Us

3571 Far West Blvd Austin, TX 78731

© Copyright 2023 Workers Care Program™. All Rights Reserved.

All rights reserved. No part of this content may be reproduced or transmitted in any form or by any means without written permission from WorkersCareProgram.com. This content is for educational purposes only and all information shared are the sole thoughts and opinions of the author. Neither this website, nor any content provided by our organization, is intended to provide personalized legal, tax, financial, investment, and definitely not medical advice. We are not selling or soliciting a security in any way, shape, or form. You should probably seek professional advice before taking any further action. Seriously. We have no idea what we're doing, but for some reason it keeps working.

YouTube and the YouTube logo are registered trademarks of Google Inc. This site is not affiliated with YouTube or Google Inc. in any way. This site is not a part of the Facebook™ website or Facebook™ Inc. Additionally, this site is NOT endorsed by Facebook™ in any way. FACEBOOK™ is a trademark of FACEBOOK™, Inc.